12 Sep 2022 Bilt World Elite Mastercard

Fly with Moxie has partnered with CardRatings for our coverage of credit card products. Fly with Moxie and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

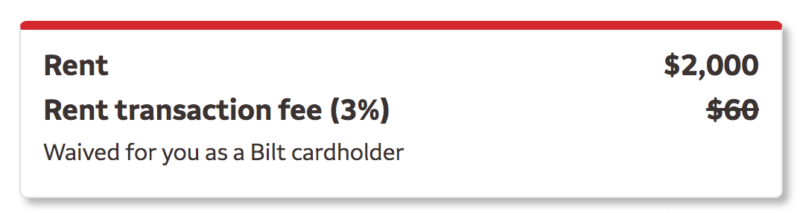

The Bilt Rewards credit card enables renters to earn credit card rewards for paying rent as well as on other purchases without a transaction fee. The Bilt Card earns 1 point per dollar on rent payments with no tansaction fee. Cardholders will earn 1 point per dollar on rent payments with no fees (on up to 100,000 points in a calendar year), 2 points per dollar on travel, 3 points per dollar on dining and 1 points per dollar on all other purchases. Use the card 5 times each statement period to earn points. The card also offers interest on points balances, complicated and qualified point bonuses for signing new and renewed leases with partner landlords and a tiered loyalty status program based on the number of points earned each year.

Earn Points Paying Rent (up to 50,000 each year) plus

- 3 points per $1 spent on dining.

- 2 points per $1 spent on travel.

- 1 point per $1 spent on rent (up to 50,000 points annually)

- 1 point per $1 spent on all other purchase.

Rewards

Earning Rewards

Cardholders will earn 1 point per dollar on rent payments with no fees (on up to 100,000 points in a calendar year), 2 points per dollar on travel, 3 points per dollar on dining and 1 points per dollar on all other purchases.

Use the card 5 times each statement period to earn points.

The card also earns interest on points balances once you reach Silver or higher tier levels at the national savings interest rate as established by the FDIC (keep in mind this is currently under 1 percent) and earns point bonuses for signing new and renewed leases with in-network Bilt Rewards Alliance landlords.

Bilt figured out how to make paying rent with a credit card feel sort of like a classic airline rewards program. The Bilt Rewards program’s status tier system determines the benefits, extras and status tiers are achieved with yearly reward earning. Point earning must be maintained each year or status will be lost:

- Blue: Anyone enrolled in Bilt Rewards with under 25,000 points

- Silver: 25,000 points earned

- Gold: 50,000 points earned

- Platinum: 100,000 points earned

Redeeming Rewards

- Cell Phone Insurance: When you pay your cell phone bill with this card, you’ll be protected up to $800 per incident and $1,000 per year, with a $50 deductible.

- Purchase Protection: New purchases are protected against theft or damage for 90 days after purchasing.

- Concierge Service: Cardholders have access to a concierge service.

- Fee Protect: You can’t use your Bilt Credit Card to pay your rent at the front office of one of Bilt’s partners, where you’ll be charged a fee. Fee Protect will block the purchase and remind you to pay via the app.

- Fees

- Annual Fee: $0

- Foreign Purchase Transaction Fee: None